Source: FY 2020 Annual Comprehensive Financial Report

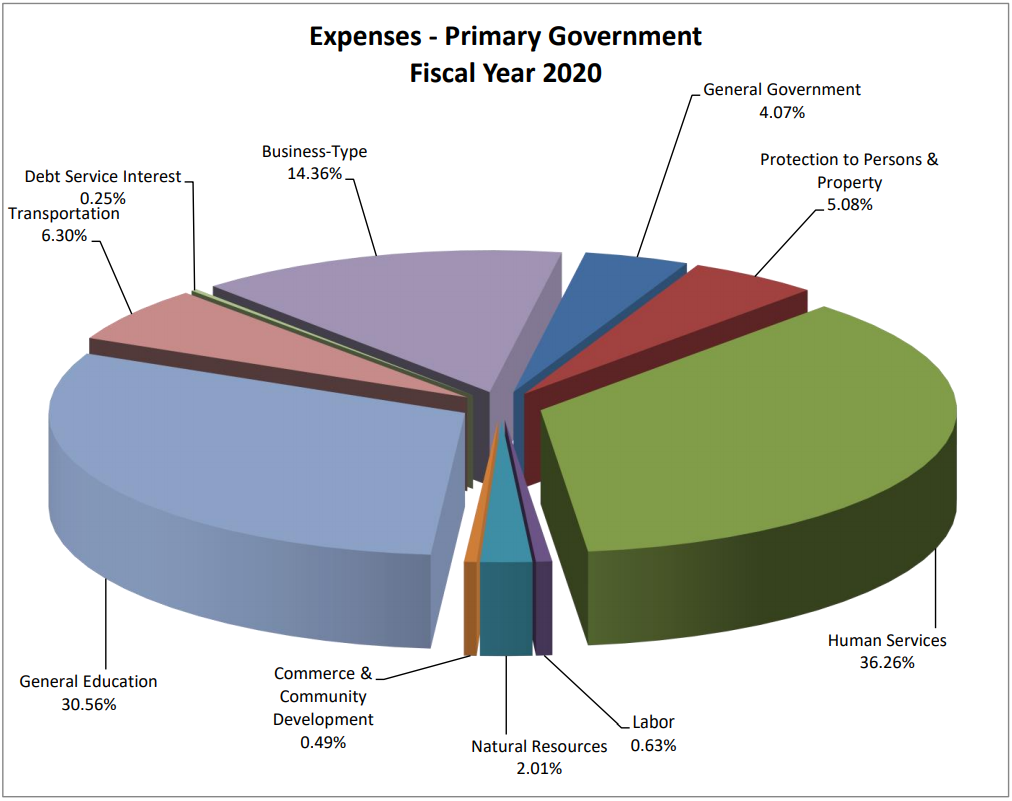

The State expends money for many reasons, including: state employee salaries and benefits; information technology, operating costs; contracts for commodities and services; grants to providers and community partners; direct program beneficiaries; capital improvements; economic development, transportation infrastructure; education; teachers’ retirement; environmental protection; public safety, debt service; and others. Payments by primary government units (State agencies, departments and other units) and business-type units (enterprise funds) are made principally through the VISION Statewide financial system and the VTHR Payroll system. Detail payments for the majority of component units, and fiscal agent managed funds, are not made though VISION. Most component units maintain separate financial reporting systems (such as the University of Vermont). They are included, however, in the Annual Comprehensive Financial Report in accordance with generally accepted accounting principals (GAAP).

Vendor payment data

The vendor payments included are exclusive of the following: direct payments to state employees for salaries, benefits and reimbursable expenses; any vendor payments deemed confidential by State and/or federal statutes and rules, or the confidential nature of the recipients of certain vendor payments (such as direct program benefit payments); and certain portions of component units, enterprise activities and fiscal agency managed funds. Approximately 81% of all expenditures (all funds, including salaries and component units) are processed through VISION and VTHR. The majority of the 19% excluded are for a portion of certain enterprise funds and component units. View a breakdown of exclusions by fund type and component units. For expenditure summary information on consolidated state spending, which includes all non-VISION payments, in accordance with GAAP, please refer to the Annual Comprehensive Financial Report(s).

Employee Compensation payment data

State employee compensation data is available. Additional statistical, trend and characteristics information about the state employee workforce is available in the Department of Human Resources' State Workforce Reports.

Employee Count and FTEs

Executive Branch employee count and FTE data is available. Additional statistical, trend and characteristics information about the state employee workforce is available in the Department of Human Resources' State Workforce Reports.

Town Payments

Town Payments including semi-annual payments to town treasurers, schools, fire districts and other municipal units are available on the Department of Finance & Management website.

Information Technology & Open Data

For additional information on contracts for services and grants, please refer to the “Contracts & Grants” section of this website.

Coronavirus Relief Fund

Appropriations and Expenditures related to federal COVID-19 aid.